Over the past weeks, I had the opportunity to attend two major events shaping my entrepreneurial perspective: the Venture Days in Luxembourg and the Web Summit in Lisbon. Both were intense, inspiring and at times overwhelming, especially because I was wearing all the hats at once.

Building a solid business plan, compelling a pitch deck, developing the software, managing stakeholders and potential customers, while simultaneously running a fast-growing open-source project is challenging. But these events gave me invaluable insights into how differently European and American investors think and why this has such a deep impact on how we must communicate.

European Investors

Pragmatic. Detail-driven. Break-even focused.

In Luxembourg and other European settings, conversations consistently revolved around questions such as:

- How fast can you reach break-even?

- Show me the exact numbers, prices and sources.

- How precisely is the market researched?

- What is the unit economics structure?

European investors tend to value stability, caution and predictability. They expect detailed business plans where every calculation is documented in depth. Market research, pricing models, competitive matrices and break-even analyses carry significant weight.

What is often missing is ambition.

The desire to change the world is frequently overshadowed by a culture centered around minimizing risk. Radical innovation becomes rare. Founders are encouraged to think small, stay safe and avoid big leaps. As a result, Europe produces far fewer breakthrough technologies.

American Investors

Vision first. Details later.

The conversations I had with American investors, both in Luxembourg and Lisbon, felt dramatically different.

Their core interests centered around questions such as:

- How do you dominate the global market?

- What is the story and the movement you are building?

- How big can this become?

- What is the monopoly you are aiming for?

American-style investors think in terms of global market power, narrative, category creation and world-changing potential. They want to invest in huge visions and massive outcomes, even if the roadmap is not fully defined yet.

For them, communication must be bold, visionary and transformative.

This Creates a Communication Challenge

Switching between these mindsets is not easy. You cannot pitch the same story in Germany as you would in Silicon Valley.

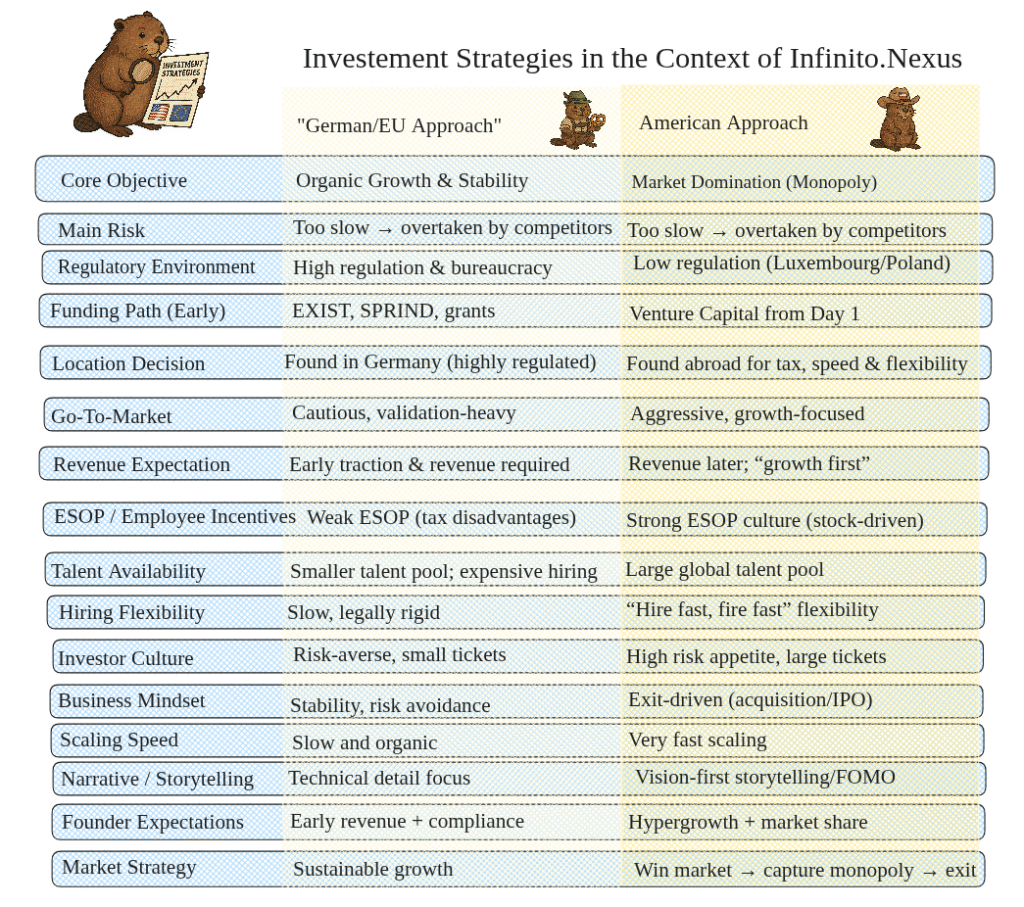

That’s why I created a communication matrix that highlights the differences between the “German/European Approach” and the “American Approach”. It helps me stay conscious about how to communicate depending on the audience and their cultural expectations.

Pitching is not just about the product — it is about the mindset of the listener.

Why We Are Building Infinito.Nexus

Infinito.Nexus aims to become the universal platform for rapidly building sovereign IT infrastructure. Organizations should be able to operate an essentially unlimited number of SaaS applications behind a single SSO layer, fully sovereign, on any servers or providers they choose, without being exposed to monopoly pressure or external control.

Our vision extends to hardware. Laptops, servers and even smartphones will be delivered preconfigured, ready to use the very next day, and immediately integrated into a sovereign infrastructure. The platform becomes the foundation for sovereign IT by combining automated deployment, full application integration and ready-to-use hardware into one seamless ecosystem.

Different Expectations in the US and Europe

US investors respond strongly to the transformative scale of this vision. For them, we explicitly highlight that Infinito.Nexus aims to become the dominant platform for sovereign IT deployments worldwide. This may sound paradoxical in the context of sovereignty, yet it is entirely compatible. Everything remains open source and users remain free to host wherever they want, but they naturally stay with us because of convenience, automation and usability. The logic is identical to how people today choose Netflix instead of downloading movies or Spotify instead of pirating music. Convenience creates loyalty.

For US investors, we emphasize that this convenience-driven retention enables us to secure long-term platform dominance. In addition, we guarantee enterprise-level SLAs and large-scale managed deployment services when the infrastructure is provisioned through our platform, which further strengthens trust at the enterprise level and reinforces our strategic position.

European investors think differently. They place higher value on predictable steps, measurable risk management and immediate practical value. While they understand the long-term vision, they expect a grounded and incremental approach that fits the realities of the European market.

Adapting the European Narrative

For the European context we present a slower and more conservative scaling strategy. Instead of focusing immediately on global automation, we begin with B2B delivery teams that manually roll out sovereign environments for startups and technologically open young companies. This lowers perceived risk but increases operational cost and reduces speed, and it creates exposure to competitors who scale more aggressively. Nevertheless, this approach aligns with the European preference for reliability, trust-building and controlled expansion.

In addition, the European narrative places a much stronger emphasis on consulting. Unlike in the US narrative, where consulting is downplayed due to poor scalability, in Europe consulting is both expected and necessary. It gives us the ability to tailor environments more deeply to customer needs, particularly for complex ERP and CRM integrations that require significant customization. Consulting also reinforces the perception of reliability and competence, which is essential for conservative investors.

A Unified Perspective

Both narratives describe the same product and the same mission. The US approach highlights global market leadership, platform dominance supported by convenience retention and enterprise-level services. The European approach emphasizes concrete value, trust-building, customization and predictable growth. The difference is not in the substance of the platform, but in how the story is framed so each audience sees exactly why Infinito.Nexus fits their worldview and investment culture.

Leave a Reply